Analysis of Trades and Trading Tips for the Euro

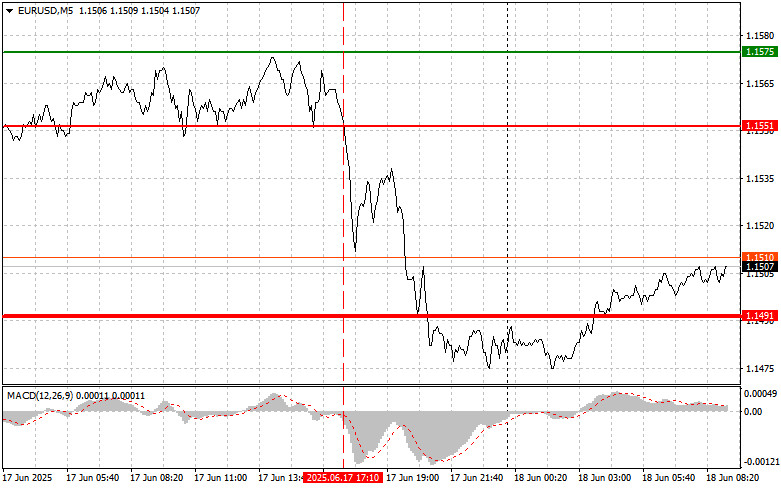

The price test of 1.1551 occurred when the MACD indicator had already moved significantly below the zero mark, which limited the euro's downside potential. As a result, I missed a fairly strong downward movement in the pair and ended up with no trades.

An emergency meeting on the Middle East yielded no concrete results. Reports emerged that within the next 48 hours, the United States may give the green light to launch a military operation against the Islamic Republic of Iran. Thus, the upcoming 48 hours could be decisive in preventing a large-scale crisis. The situation in the region is extremely tense. Iran and Israel are not engaged in negotiations—only in mutual missile strikes. The main point of contention remains Iran's nuclear program. Therefore, these specific developments will determine the dollar's future direction.

This morning, the eurozone's Consumer Price Index data for May will be released. The forecast suggests the figure will remain below 2.0%, specifically at 1.9%. This indicator is a key benchmark for the European Central Bank when setting future monetary policy. Persistently low inflation could encourage the ECB to continue its dovish policy stance.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

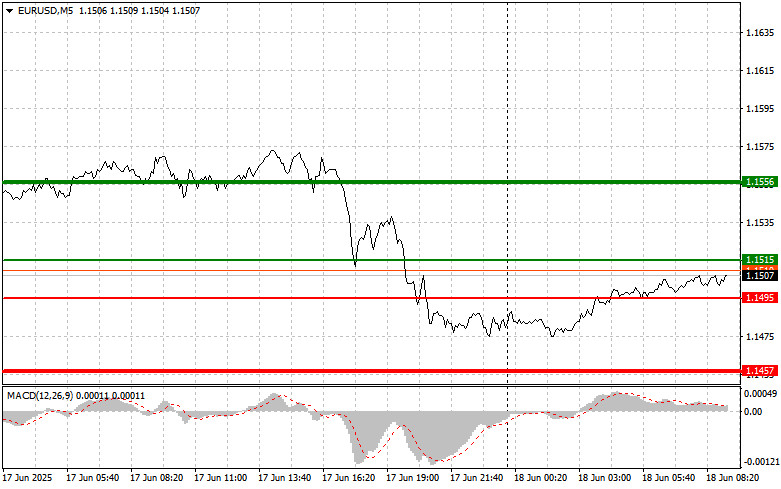

Scenario #1: I plan to buy the euro today upon reaching the price area of around 1.1515 (green line on the chart) with a target of rising to 1.1556. At 1.1556, I intend to exit the market and open a short position in the opposite direction, expecting a 30–35 pip retracement from the entry level. A bullish euro scenario today is only reasonable following strong economic data.

Important! Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1495 level while the MACD indicator is in oversold territory. This will limit the pair's downside potential and trigger an upward reversal. A rise to the opposite levels of 1.1515 and 1.1556 can be expected.

Sell Scenario

Scenario #1: I plan to sell the euro after reaching the 1.1495 level (red line on the chart). The target will be 1.1457, at which point I will exit the market and immediately enter a long position in the opposite direction (expecting a 20–25 pip move in the opposite direction from the level). Pressure on the pair may return today if data comes in weak.

Important! Before selling, make sure the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1515 level while the MACD indicator is in overbought territory. This will limit the pair's upside potential and lead to a downward market reversal. A drop to the opposite levels of 1.1495 and 1.1457 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.