The GBP/USD currency pair continued its upward movement on Friday. If we had seen such price action away from peak levels, there would have been no questions. In essence, it was a rise of about 30–40 pips—just typical market noise. However, the British pound has been steadily appreciating for seven consecutive days; even holidays couldn't stop it.

We believe the British currency is now rising purely by inertia—or on speculative grounds. Despite a 16-year-long decline, the pound has shown upward momentum more frequently than justified by fundamental and macroeconomic data over the past two years. The UK economy continues to struggle, but this seems to matter little to traders. Their focus is now entirely on U.S. trade policy and the outcome of the trade war. However, there weren't any significant updates on this topic last week. Even the euro paused and spent the week moving sideways. Yet the pound continues trading on its terms.

Currently, the only real growth driver for the British currency seems to be Donald Trump. Of course, the Bank of England's relatively hawkish stance may play a role, but if that's the case, why does the European Central Bank's dovish stance have no impact on the euro? The reality is that the dollar can now either remain flat or continue falling. There's no third option. If a piece of news is positive for the dollar, the best-case scenario is that it holds its ground. If the news is negative, the market eagerly sells off the dollar.

All this increasingly resembles a market-wide protest against Trump. Half the world is now opposed to him—not just foreign governments but also ordinary citizens, who, amid the new trade policies from the White House, have decided they don't need American goods. The logic is simple: if the U.S. is imposing "draconian" trade terms, maybe it's better to avoid dealing with America altogether.

What do tariffs mean? Prices for all imported goods in America will rise, so demand for them will decrease. As a result, European or Chinese producers will earn less. This leads to layoffs, business closures, and GDP growth slowdowns. And the reason is apparent—Trump. Many consumers in the EU are now intentionally avoiding American goods, with stores labeling items with the country of origin to help consumers identify U.S. products.

In all honesty, the current situation in the currency market looks like a war against the dollar and Trump. All positive factors for the dollar are being ignored because the market is simply refusing to buy the U.S. currency.

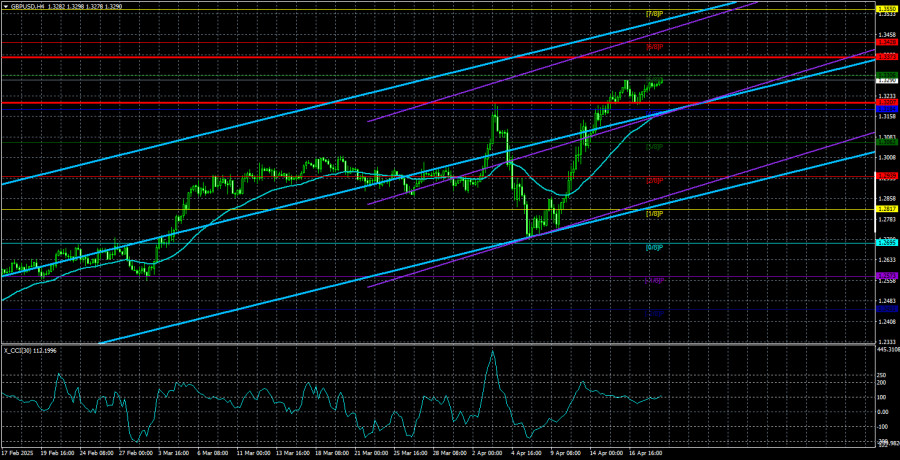

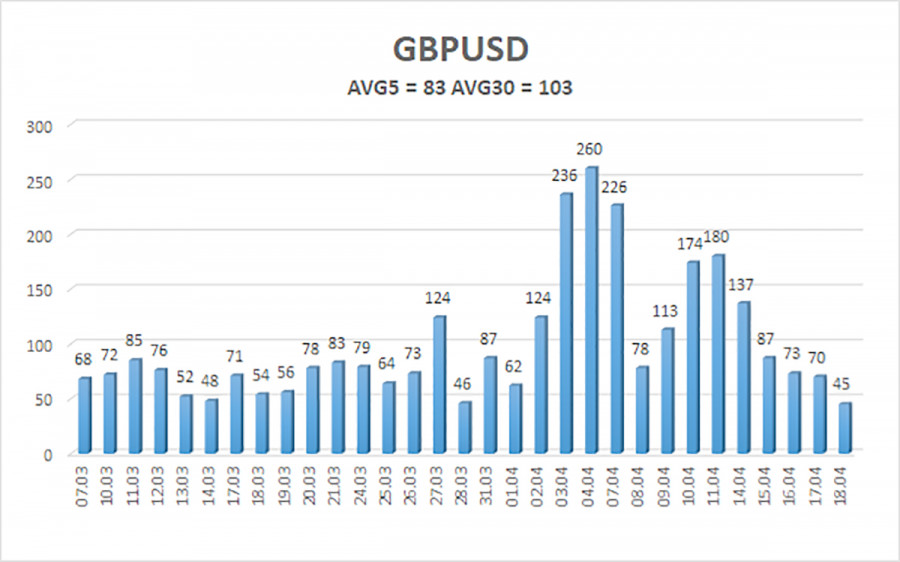

The average volatility of GBP/USD over the last five trading days is 83 pips. For the GBP/USD pair, this is considered "average." Therefore, on Monday, April 21, we expect movement within the range bounded by 1.3207 and 1.3373. The long-term regression channel points upward, but a bearish trend remains in the daily time frame. The CCI indicator has entered the overbought zone, signaling a potential downward pullback—but the correction appears to have already played out.

Nearest Support Levels:

S1 – 1.3184

S2 – 1.3062

S3 – 1.2939

Nearest Resistance Levels:

R1 – 1.3306

R2 – 1.3428

R3 – 1.3550

Trading Recommendations:

The GBP/USD pair continues its confident upward trend. We still view the upward movement as a correction in the daily time frame, which has become increasingly illogical. However, if you're trading "purely on technicals" or "on Trump," long positions remain valid with targets at 1.3373 and 1.3428 since the price is above the moving average. Especially considering the pound keeps rising day after day without clear reasons. Sell orders remain attractive, with targets at 1.2207 and 1.2146, but currently, the market isn't even considering buying the dollar, and Trump continues to provoke fresh sell-offs of the U.S. currency.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.