The GBP/USD currency pair also traded higher on Friday. However, it's worth noting that the British currency—once praised for its remarkable resilience against the dollar in recent years—is now rising more slowly than the euro. Pound volatility is also lower than that of the euro, which seems a bit unusual.

The movement's strength is not the most important thing right now. What matters most is that the dollar continues to weaken at full speed on any news related to the escalation of the "U.S. vs. The Rest of the World" trade conflict. Markets have largely lost interest in Trump's trade wars with smaller, economically weaker countries. Traders now focus on confrontations like "U.S. vs. China" or "U.S. vs. the European Union." Everyone understands perfectly well that a trade deal with Macedonia (figuratively speaking) won't move the needle on the U.S. trade balance. Meanwhile, the heavyweight opponents of the U.S. seem in no rush to negotiate with Trump.

To be fair, neither Brussels nor Beijing has ruled out the desire to reach agreements with Washington. But have you ever heard Trump himself speak of any negotiations? Trump is waiting for EU and Chinese delegations to crawl to him on their knees and beg for a deal. He wants to hold the "strong hand" at the negotiating table and demands to be courted for concessions. To motivate his trade opponents, he slaps them with triple-digit tariffs. Manipulation, threats, blackmail, bluffing—nothing new from the U.S. president.

The market continues to respond to Trump with broad sell-offs of U.S. assets. Of course, that doesn't mean the American stock market will crash to zero. There will never be a time when nobody wants Apple shares. However, we cannot ignore that during Trump's presidency, the stock market is declining, the bond market is declining, and even the cryptocurrency market is under pressure. Everything is falling.

As a result, America is no longer the country everyone wants to get into, as it once was. It's no longer the country everyone wants to trade with or collaborate on joint ventures. And every country in the world is feeling the consequences of that shift.

We should also remind ourselves that the word "victory" in Trump's vocabulary means whatever he decides it means. Even if no trade deal is signed, he could, at any moment, claim that "you have to be flexible," that "he scared everyone," that "he got what he wanted," and—why not—that "he won a golf match at his own club." For Trump, it doesn't matter what the real outcomes of his trade, foreign, or domestic policies are. Any positive changes will be chalked up to his achievements. All negative outcomes will be blamed on the Federal Reserve, the Democrats, the EU, China, and the rest of the world that "keeps robbing the U.S." If no positive changes occur at all, he'll just make some up. He can always say that a more modest lifestyle for Americans is good. In short, Season 2 of the "Trump" series began three months ago, and we have four years of entertainment ahead. Boredom is not on the menu.

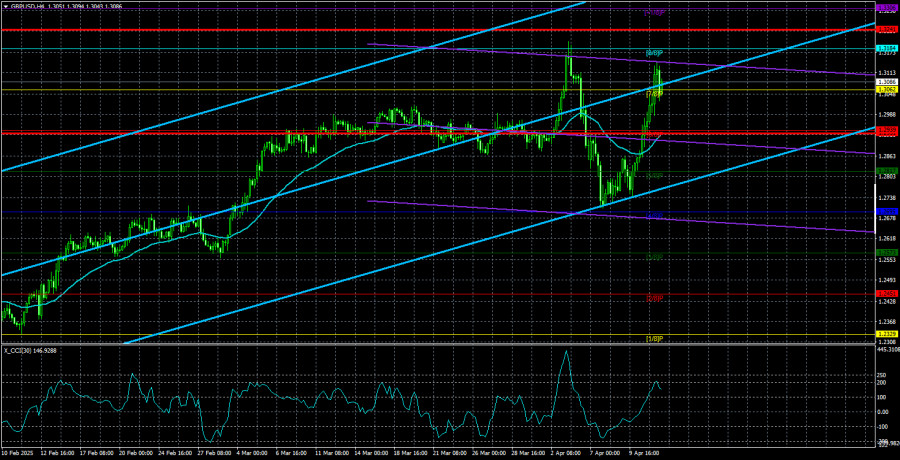

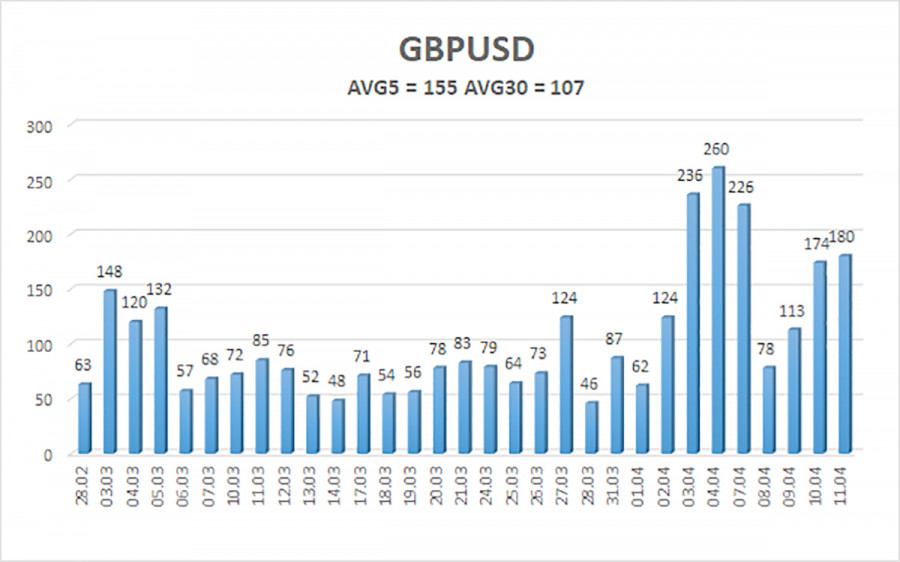

The average volatility of the GBP/USD pair over the last five trading days stands at 155 points, which is considered "high" for this pair. Therefore, on Monday, April 14, we expect the pair to move within the range of 1.2931 to 1.3241. The long-term regression channel is pointing upward, though a downward trend is still in place on the daily time frame. The CCI indicator recently entered overbought territory, indicating a downward pullback that has already concluded.

Nearest Support Levels:

S1 – 1.3062

S2 – 1.2939

S3 – 1.2817

Nearest Resistance Levels:

R1 – 1.3184

R2 – 1.3306

R3 – 1.3428

Trading Recommendations:

The GBP/USD pair experienced a sharp decline, which most likely has already concluded. We still do not recommend long positions, as we believe the current upward movement is a correction on the daily timeframe that has become increasingly irrational. However, if you trade based on pure technicals or the "Trump factor," long positions are justified with targets at 1.3184 and 1.3241 since the price is currently above the moving average. Sell orders remain attractive with targets at 1.2207 and 1.2146, as sooner or later, the upward correction on the daily chart will come to an end (assuming the downtrend hasn't ended by then). Still, at this point, with Trump raising tariffs almost daily and the dollar in a freefall, the bearish pressure remains intense.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.