Analysis of Trades and Trading Tips for the British Pound

The test of the 1.3410 price level occurred when the MACD indicator had just begun to move upward from the zero line, confirming a valid entry point for buying the pound, which led to a rise of over 30 points.

Yesterday's UK inflation figures, which came in higher than economists' forecasts, did not provide substantial support for the British pound. This paradoxical market reaction underscores the intricate relationship between macroeconomic indicators and investor sentiment, as well as the impact of a broad range of other factors that influence exchange rates.

In theory, elevated inflation should have pushed the Bank of England toward a more aggressive monetary policy, which in turn would have made the British pound more attractive to investors. However, reality turned out differently. It is likely that the market had already priced in the possibility of rising inflation before the official release, or that concerns about the UK's economic growth outweighed the positive impact of inflation figures.

Today brings another round of important data from the UK. It will begin with data on jobless claims and the unemployment rate. These indicators are crucial for assessing the overall condition of the UK labor market and its potential influence on economic growth. An increase in jobless claims signals a worsening employment situation, hinting at a possible slowdown in economic growth. Conversely, a decrease in this figure points to a stable or even improving labor market, which generally supports consumer spending and investment activity. The unemployment rate, in turn, provides a broader view of the labor market. A low unemployment rate indicates a labor shortage and potential wage growth, which could lead to increased inflation. A high unemployment rate, on the other hand, suggests a labor surplus and may lead to lower wages and slower economic growth.

Overall, today's labor market data will provide valuable insight into the UK's economic outlook and help shape expectations regarding the Bank of England's future monetary policy direction.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

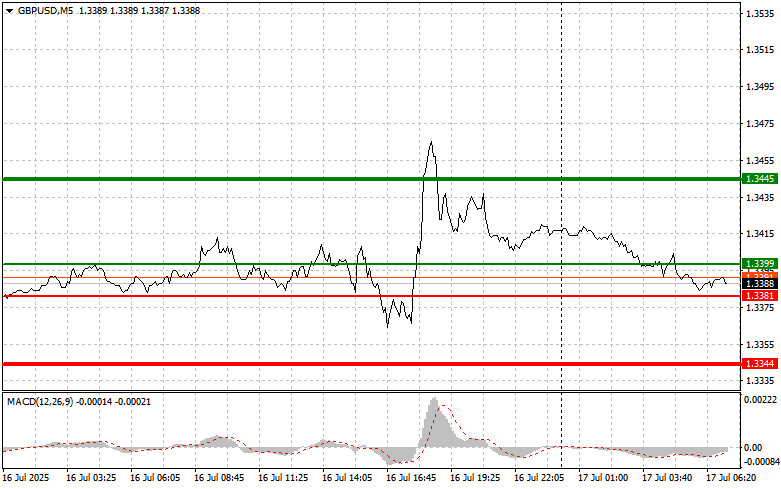

Scenario #1: I plan to buy the pound today at the 1.3399 entry point (green line on the chart), aiming for a rise to 1.3445 (thicker green line on the chart). Around 1.3445, I intend to exit long positions and open short positions in the opposite direction (anticipating a 30–35 point pullback). A pound rally today is likely only if the UK unemployment rate decreases.

Important! Before buying, make sure that the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the 1.3381 level, while the MACD indicator is in oversold territory. This would limit the downside potential of the pair and trigger a reversal upward. A rise toward 1.3399 and 1.3445 can be expected.

Sell Scenario

Scenario #1: I plan to sell the pound today after it breaks below 1.3381 (red line on the chart), which may lead to a sharp decline. The key target for sellers will be 1.3344, where I intend to exit short positions and immediately open long positions in the opposite direction (aiming for a 20–25 point rebound). Selling the pound on strength remains in line with the prevailing bearish trend.

Important! Before selling, make sure that the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.3399 level, while the MACD indicator is in overbought territory. This would limit the pair's upward potential and trigger a reversal downward. A decline toward 1.3381 and 1.3344 can then be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.