On Tuesday, the GBP/USD currency pair maintained its upward bias, although it failed to post significant gains throughout the day. However, this is not an issue. The U.S. dollar has been declining with such strength and consistency over the past six months that waiting a few days poses no concern. In nearly every article, we emphasize a single point: the dollar has no real reason to post medium-term growth. Corrections within an uptrend are possible and even necessary. One of these corrections has been unfolding over the past three weeks—and it may not even be over yet. But there are no fundamental reasons for the dollar to rise.

On the other hand, there are numerous fundamental reasons for the dollar to decline. We won't even reiterate the ongoing trade war, which could continue to be a major burden for the U.S. currency for quite some time. Just over the past month, Donald Trump has introduced a new topic of concern for currency traders. Now, the U.S. president is not only calling on Jerome Powell to resign—he seems prepared to take any necessary measures to force him out.

From the outside, the situation appears absurd and comical, much like many other developments in the United States today. Current events in the U.S. are incredibly fascinating to watch, as Trump continues to demonstrate how laws function in a democratic country. The president cannot authorize a strike on a foreign state without Congress's approval—but if it's really necessary, it somehow becomes possible. Imposing global tariffs without congressional approval is prohibited by the Constitution—but if truly needed, a national emergency can be declared, and it becomes permissible. The U.S. military is not allowed to be used against its own citizens—but if protestors need to be dispersed, then it's allowed. The president doesn't have the authority to fire the Fed Chair—but if really needed, allegations can be fabricated, and with a majority in both chambers of Congress, even that can be forced through.

Let's be honest—does anyone honestly believe that Jerome Powell is guilty of the accusations being brought against him? First of all, this is not about renovations to Powell's private estate or apartment, but rather the Federal Reserve building, which is, in theory, government property. The Fed buildings haven't undergone renovations in nearly 100 years, and we're talking about massive structures that inherently cannot be refurbished cheaply. Moreover, it remains unclear whether such renovations have even begun. There is no information online about when this alleged repair took place. Thus, it appears the renovation hasn't even started yet, and Powell is set to step down in nine months. It's abundantly clear that Powell wasn't planning renovations for his own comfort.

All in all, the situation looks like a classic "witch hunt"—a term Trump himself loves to use. Naturally, all Republicans are "singing the same tune" as their president. For example, Republican Anna Luna claimed that the Fed building was already renovated in the 2000s, although such information is again nowhere to be found online. In short, a costly new renovation doesn't seem necessary at all—yet it is being framed as if Powell wanted VIP elevators and a few gardens inside the building.

In summary, Republicans are doing everything they can to push Powell to resign. For the Fed Chair, this has become a matter of personal honor. If things continue in this direction, Powell might not just leave his post—he could be forced out in disgrace, branded as a fraud and a liar. As a result, he will now have to "clear his name." As for the structure of the Federal Reserve itself, public trust in it will likely plunge to rock bottom after Powell's departure. Trump would then essentially run the Fed as well. And under Trump, the dollar continues to decline.

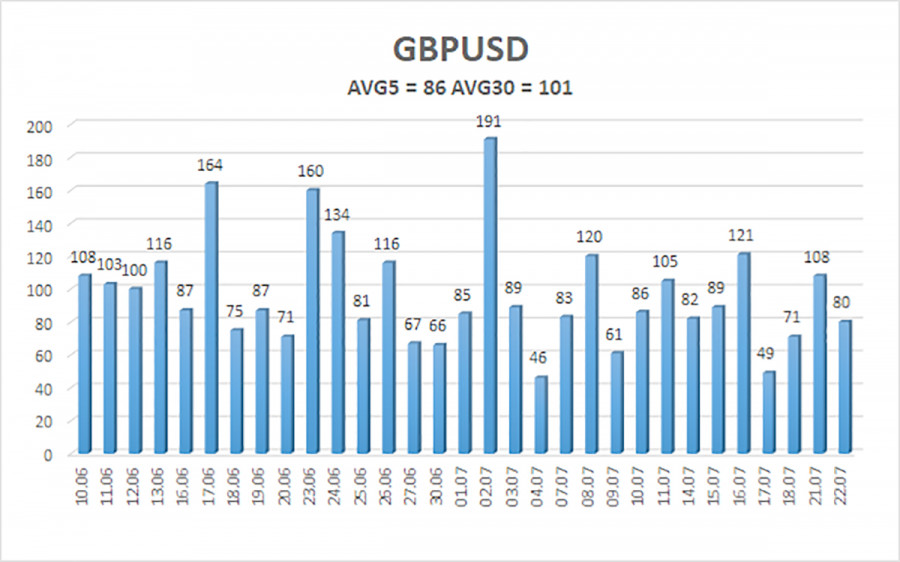

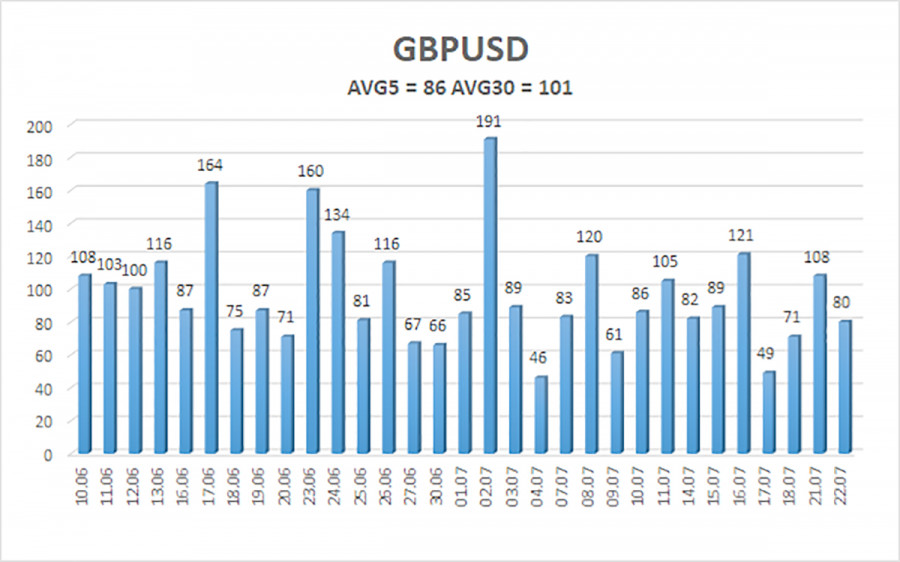

The average volatility of the GBP/USD pair over the past five trading days is 86 pips. For the pound/dollar pair, this is considered "moderate." On Wednesday, July 23, we expect movement within the range defined by 1.3438 and 1.3610. The long-term linear regression channel is pointing upward, indicating a clear uptrend. The CCI indicator has twice entered the oversold area, which previously signaled the resumption of the upward trend. Bullish divergences have also formed.

Nearest Support Levels:

S1 – 1.3489

S2 – 1.3428

S3 – 1.3367

Nearest Resistance Levels:

R1 – 1.3550

R2 – 1.3611

R3 – 1.3672

Trading Recommendations:

The GBP/USD pair may resume its upward trend. The pair has undergone sufficient correction, and in the medium term, Trump's policies are likely to continue exerting downward pressure on the dollar. Thus, long positions remain relevant above the moving average, with targets at 1.3611 and 1.3672. If the price drops below the moving average line, short positions can be considered with targets at 1.3428 and 1.3367, based purely on technical reasoning. While the U.S. dollar occasionally stages corrections, it would need clear signs of an end to the global trade war to establish a sustainable upward trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.