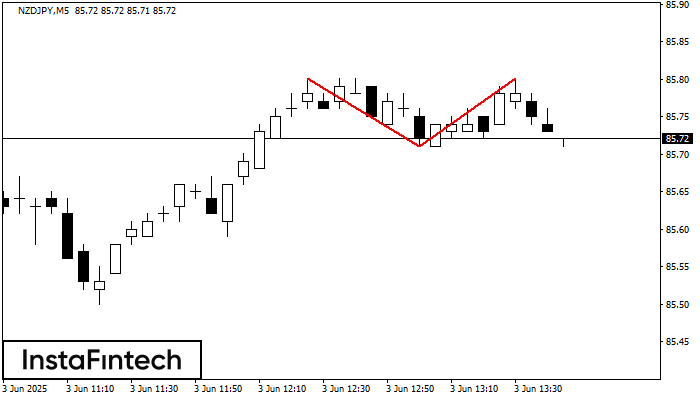

was formed on 03.06 at 12:45:53 (UTC+0)

signal strength 1 of 5

signal strength 1 of 5

On the chart of NZDJPY M5 the Double Top reversal pattern has been formed. Characteristics: the upper boundary 85.80; the lower boundary 85.71; the width of the pattern 9 points. The signal: a break of the lower boundary will cause continuation of the downward trend targeting the 85.56 level.

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength