Wall Street Charges Ahead: S&P 500 Notches Sixth Consecutive Record

On Monday, US stock markets delivered more surprises as the S&P 500 ended the session at another all-time high for the sixth day running. The Nasdaq also reached its own record level, despite heightened market volatility. Investors are now weighing the fresh trade deal between the US and the EU while bracing for a week packed with significant updates.

US and EU Move Toward Lower Tariffs

After weekend talks, US President Donald Trump and European Commission President Ursula von der Leyen announced a breakthrough framework agreement that will see European import tariffs halved to 15 percent. The planned tariff hike scheduled for August first was avoided, easing tensions between the two sides. France, however, was quick to criticize the deal, calling it a capitulation.

America Strengthens Global Trade Ties

The US-EU accord follows a string of recent trade agreements, including new deals announced with Japan and Indonesia. Meanwhile, senior officials from the US and China resumed negotiations in Stockholm, attempting to find common ground and resolve ongoing trade disputes between the economic giants.

Strong Signs Amid Cautious Optimism

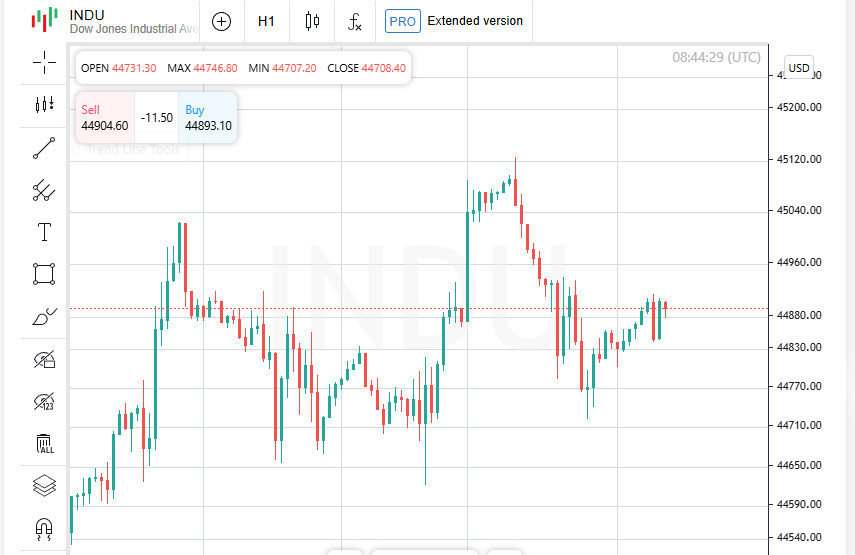

The Dow Jones Industrial Average slipped by 64.36 points, or 0.14 percent, settling at 44,837.56. The S&P 500 edged up by 1.13 points, or 0.02 percent, finishing at 6,389.77. The Nasdaq Composite climbed by 70.27 points, or 0.33 percent, closing at 21,178.58.

The S&P 500 has now set six consecutive closing highs and is on track for its fifteenth record finish this year. US stocks have staged a steady recovery from the sell-off in early April that was triggered by the announcement of fresh tariffs from the White House.

Artificial Intelligence Hype and Corporate Reports Drive Market Surge

Optimism around the future of artificial intelligence continues to fuel major stock gains worldwide. Investor enthusiasm is further boosted by encouraging news on recent trade agreements and by early indications that company earnings this season may surpass even the most optimistic forecasts.

Eyes on the Fed as Political Pressure Mounts

This week, the spotlight shifts to the US Federal Reserve, with Wednesday's policy statement eagerly anticipated by market watchers. Most analysts expect interest rates to remain steady, despite persistent calls from President Trump urging Fed Chair Jerome Powell to cut lending costs.

Tech Titans Ready to Move the Market

Quarterly earnings announcements from industry leaders such as Microsoft, Amazon, Apple and Meta are set to capture the market's attention and could shift investor sentiment in either direction, with each report under close scrutiny for signs of continued sector strength.

Fresh Economic Data in the Pipeline

Alongside the Fed meeting and corporate updates, investors are awaiting several key economic releases. Special focus will be on the Personal Consumption Expenditures index, the Fed's preferred measure of inflation, as well as new figures for government-sector employment, which will help assess the impact of recent tariffs on consumer prices and the job market.

Nike Shines after Analyst Upgrade

Nike shares rallied by nearly four percent following an upbeat outlook from J.P. Morgan, whose analysts not only upgraded their rating but also issued a simple directive: buy.

Energy Outperforms While Real Estate Lags

The energy sector led the S and P's gains, climbing more than one percent due to a two percent surge in oil prices. In contrast, real estate and materials lagged behind, each sector closing lower by more than one percent.

Asian Stocks Slide as Euro Seeks a Foothold

Tuesday brought fresh declines across Asian stock exchanges, while the euro tried to recover after recent losses. Investors remain focused on the shortcomings of the US-EU trade agreement, which has done little to ease strict tariff measures. Persistent fears that these barriers will remain in place continue to dampen hopes for stronger growth and raise concerns about potential inflationary pressures.

Europe Reacts Warily to New Trade Terms

The initial relief surrounding the introduction of a fifteen percent tariff in Europe quickly faded, especially compared to the previous one to two percent rates that existed before Donald Trump's presidency. French and German leaders voiced disappointment, warning that the outcome hampers economic expansion, weakens bond and equity returns across the continent, and undermines the euro's strength.

Cautious Sentiment Reflects in the Markets

Apprehension was visible in trading patterns: the MSCI Asia-Pacific Equity Index sank by nearly zero point eight percent. Japan's Nikkei benchmark slipped by nearly zero point nine percent, while China's blue-chip index held steady. In Europe, following Monday's sharp sell-off, markets showed signs of stabilization, with futures for the EUROSTOXX 50, FTSE, and DAX all posting modest gains of around zero point two percent.

Currency Volatility: The Dollar Moves Up as Euro Holds Ground

The euro struggled to recover after a steep overnight fall of over one point three percent, marking its largest single-session drop since mid-May. By Tuesday, the euro was sitting at one point one five eight seven against the US dollar, just above a critical support level near one point one five five six.

Meanwhile, the US dollar index climbed to ninety eight point six seven five after traders exited short positions, pushing the greenback up by one percent. The Japanese yen retreated from its weekly highs, settling at one hundred forty eight point two seven.

US Futures Edge Higher

American futures posted modest gains, with the S and P five hundred up by zero point one percent and Nasdaq futures advancing by zero point two percent.

Investors Await Economic Signals to Guide Rates

This week, financial players are watching closely for a fresh batch of US economic reports that could steer interest rate expectations. The spotlight will be on the second quarter GDP numbers, where markets are anticipating a rebound to two point four percent annual growth, recovering from the half-percent contraction seen in the first quarter.

Labor Market Takes Center Stage

Tuesday promises new insights into the health of the job market, with vacancy figures due for release. These statistics will help refine strategies ahead of Friday's crucial employment report, a key indicator that often sets the tone for trading activity.

Bank of Canada Holds Steady Ahead of Trade Decisions

Midweek focus shifts to Canada, where the central bank is widely predicted to keep its policy rate at two point seventy-five percent. Decision-makers opt for a wait-and-see approach, keeping an eye on ongoing trade discussions with the United States before making any moves.

Commodity Markets Move in Different Directions

Industrial metals are under pressure as copper and iron ore prices face headwinds from uncertain demand. Gold remains firm at three thousand three hundred fifteen dollars per ounce, reflecting a safe haven amid broader volatility.

Oil Prices Adjust After Recent Rally

Brent crude eased back to sixty-nine dollars ninety cents a barrel, following a surge of over two percent at the start of the week. In contrast, US crude remained unchanged at sixty-six dollars sixty cents per barrel, signaling steady conditions in the American energy market.