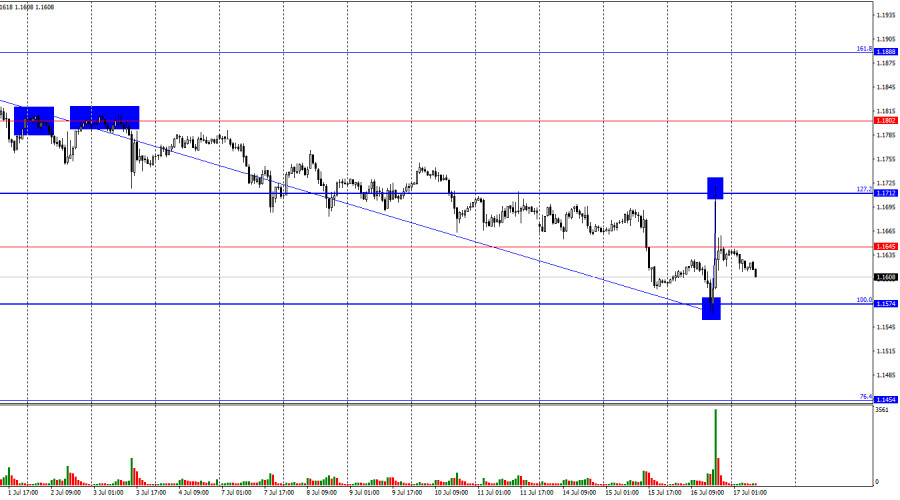

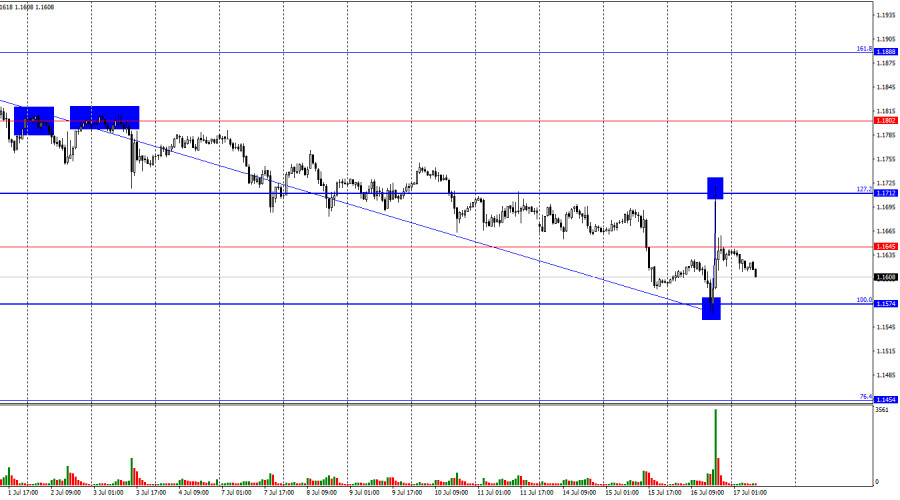

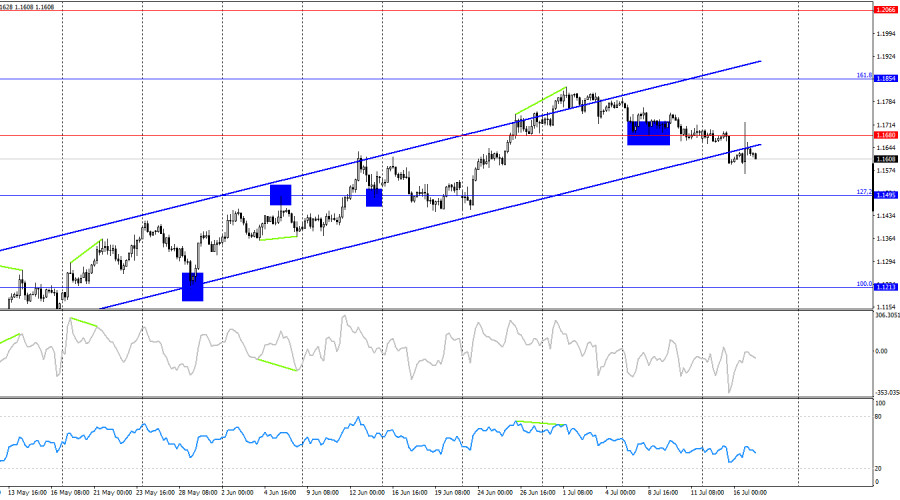

On Wednesday, the EUR/USD pair reached the 100.0% corrective level at 1.1574, rebounded from it, and rose to the 127.2% Fibonacci level at 1.1712, from which it also bounced. As a result, the latest reversal favored the U.S. dollar, and on Thursday morning, the bears resumed their attacks toward the 1.1574 level. Another rebound from this level will again work in favor of the euro, with a potential rise toward 1.1645 and 1.1712. A consolidation below 1.1574 will increase the likelihood of further decline toward the next corrective level of 76.4% at 1.1454.

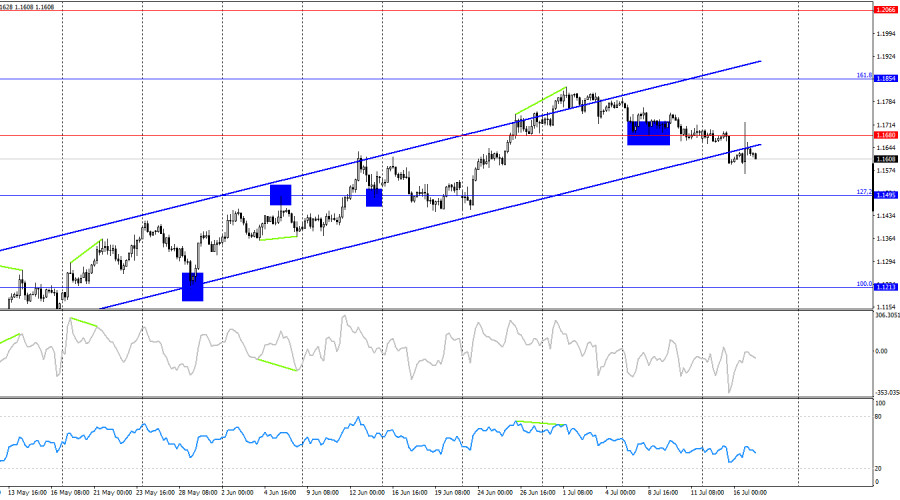

The wave structure on the hourly chart remains simple and clear. The last completed downward wave did not break the low of the previous wave, and the most recent upward wave failed to surpass the previous peak. Therefore, the trend remains "bullish" for now. The lack of real progress in U.S. trade negotiations, the low likelihood of trade deals with most countries, and new tariff hikes continue to paint a grim outlook for the bears, even though they have been active in recent weeks.

In the past few weeks, the U.S. dollar has strengthened significantly, although the news background has not always supported this move. However, yesterday the dollar sharply fell across the market. This happened in the evening, and the bulls failed to build on their success. By Thursday morning, the pair had returned to the levels from which the previous growth began. On Wednesday evening, Donald Trump once again brought up Jerome Powell, stating he had no intention of firing him but that Powell might have to resign due to financial misconduct. The U.S. president was referring to the Federal Reserve's spending on renovating two of its own buildings, totaling over 2.5 billion dollars. It should be noted that the renovation project was approved by Congress and the Treasury back in 2021. Only now are questions arising about the inflated cost. I doubt Powell personally decides how much to spend on building renovations. This whole situation looks like Trump failed to fire Powell and now wants to force him to resign voluntarily.

On the 4-hour chart, the pair has consolidated below the 1.1680 level as well as below the ascending trend channel. Thus, the "bullish" trend is beginning to shift toward "bearish," though I would be cautious with such conclusions. Despite the dollar rising for the third consecutive week, its fundamental foundation remains weak. I believe the market is not ready to buy dollars on a multi-month or multi-year horizon. Traders still don't understand what the trade war will ultimately mean for the U.S., so the current dollar growth appears more like a deceptive rally.

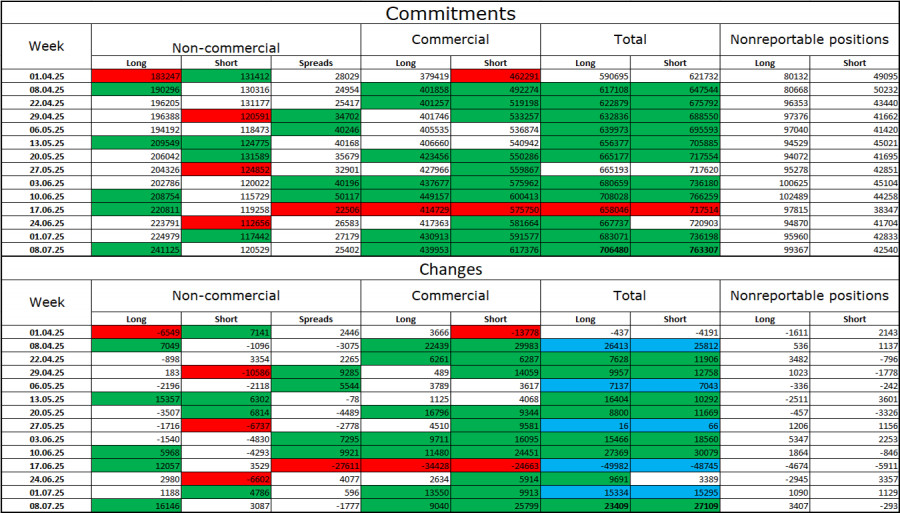

Commitments of Traders (COT) Report:

Over the last reporting week, professional traders opened 1,188 long positions and 4,786 short positions. The sentiment among the "Non-commercial" category remains bullish thanks to Donald Trump and continues to strengthen over time. The total number of long positions held by speculators is now 225,000, while short positions number 117,000 — and the gap, with few exceptions, continues to widen. This shows strong demand for the euro, but not for the dollar. The situation remains unchanged.

For 22 consecutive weeks, large players have been reducing their short positions and increasing their longs. Although there is a significant difference in the monetary policies of the ECB and the Fed, Donald Trump's actions are a more decisive factor for traders, as they could trigger a U.S. recession and other long-term, structural problems for the American economy.

News Calendar for the U.S. and the Eurozone:

- Eurozone – Consumer Price Index (09:00 UTC)

- U.S. – Retail Sales Change (12:30 UTC)

- U.S. – Initial Jobless Claims (12:30 UTC)

The July 17 economic calendar includes three entries, none of which can be considered major. The influence of the news background on market sentiment on Thursday will likely be minimal.

EUR/USD Forecast and Trader Advice:

I would not recommend selling the pair today, as the recent market movement has been too weak and unstable. Buying was possible on a rebound from the 1.1574 level on the hourly chart with a target of 1.1645, and this target was reached. Today, buying again from 1.1574 is an option, with targets at 1.1645 and 1.1712.

The Fibonacci level grids are drawn from 1.1574–1.1066 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.