EUR/USD

Analysis:

The main euro pair remains in an upward trend. The current segment is a corrective phase that began in early July. The price is located between clusters of potential reversal levels on various timeframes. Over the past two weeks, quotes have formed an upward segment that remains within the bounds of the current corrective wave.

Forecast:

In the coming week, a continuation of the sideways movement within the nearest zones is expected. Initially, the pair may rise toward the resistance boundaries. Toward the end of the week, a reversal is likely, followed by the beginning of a price decline.

Potential Reversal Zones:

- Resistance: 1.1810 / 1.1860

- Support: 1.1660 / 1.1610

Recommendations:

- Buy: Can be used intraday with reduced lot size.

- Sell: Consider only after confirmed reversal signals appear near resistance.

USD/JPY

Analysis:

The yen's major pair has been developing an upward wave since August last year. The latest incomplete segment, from April 22, is forming a pullback in the form of an extended flat. The wave structure is nearing completion.

Forecast:

Sideways movement is expected in the coming days, with a possible downward drift toward support levels. Toward the end of the week, the probability of a reversal and a resumption of upward movement increases, potentially reaching the projected resistance zone.

Potential Reversal Zones:

- Resistance: 150.00 / 150.50

- Support: 147.00 / 146.50

Recommendations:

- Sell: Short-term trades are possible but safer with smaller lot sizes.

- Buy: May be considered upon confirmation of signals near support.

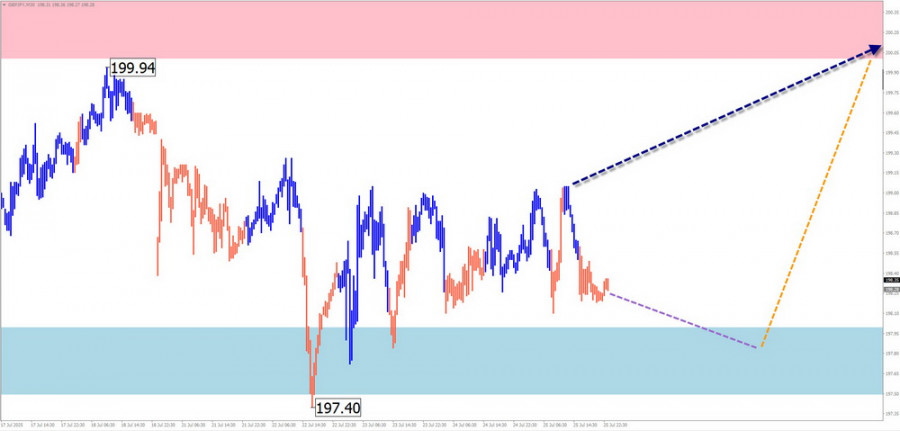

GBP/JPY

Analysis:

The cross pair of the British pound and Japanese yen has been in an upward wave since September last year. In the past month, the price has been within a strong weekly reversal zone. The current corrective phase started in early July and is close to completion.

Forecast:

Sideways movement is likely to continue through the week, with a possible dip toward support levels. By Friday or early next week, the probability of a reversal and price increase rises.

Potential Reversal Zones:

- Resistance: 200.00 / 200.50

- Support: 198.00 / 197.50

Recommendations:

- Sell: Risky and could lead to losses.

- Buy: Relevant after confirmed signals appear near support.

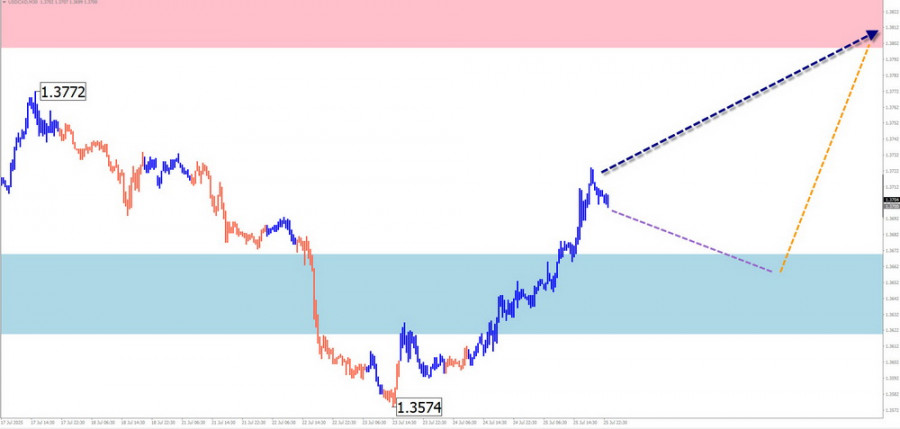

USD/CAD

Analysis:

The ascending flat structure that began in late May remains incomplete. The pair has been drifting along the upper boundary of a broad reversal zone. The wave extremums form a "broadening triangle" on the chart. The final section of the wave is still missing.

Forecast:

Sideways movement is expected over the next few days, possibly declining toward support. A reversal and resumption of the bullish trend may occur in the second half of the week.

Potential Reversal Zones:

- Resistance: 1.3800 / 1.3850

- Support: 1.3670 / 1.3620

Recommendations:

- Buy: Monitor for entry signals near support for optimal timing.

- Sell: Risky with limited potential.

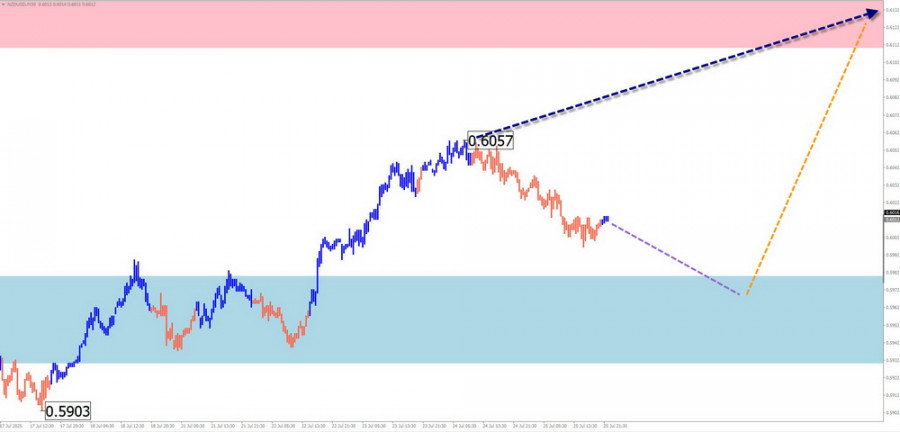

NZD/USD

Brief Analysis:

The pair has been in an upward wave since mid-June. In recent weeks, the price has been forming the middle part (B) as a horizontal flat. The latest downward segment started on July 24.

Weekly Forecast:

A continuation of the decline is likely early in the week until support is reached. A reversal and resumption of growth may occur closer to the weekend. The anticipated upward range is limited by the resistance zone.

Potential Reversal Zones:

- Resistance: 0.6110 / 0.6160

- Support: 0.5980 / 0.5930

Recommendations:

- Sell: Use with caution during specific sessions and smaller lots.

- Buy: Possible once reversal signals appear near support.

GOLD

Analysis:

In the short term, gold is moving in a bearish wave from April 22. On a larger wave model, this is the middle part of a corrective pattern. Since July 23, the price has been falling, breaking through the upper level of a strong reversal zone.

Forecast:

A sideways trend is expected for the rest of the week. A brief rise is possible early on, but a reversal near resistance is likely. The price may resume declining by the end of this or early next week.

Potential Reversal Zones:

- Resistance: 3360.0 / 3380.0

- Support: 3280.0 / 3260.0

Recommendations:

- Sell: Relevant after confirmed signals appear near resistance.

- Buy: Risky and may lead to losses.

Note:

In simplified wave analysis (SWA), all waves consist of three parts (A-B-C). Only the last unfinished wave is analyzed for each timeframe. Expected movements are shown as dashed lines.

Caution:

The wave algorithm does not account for the time duration of price movements!