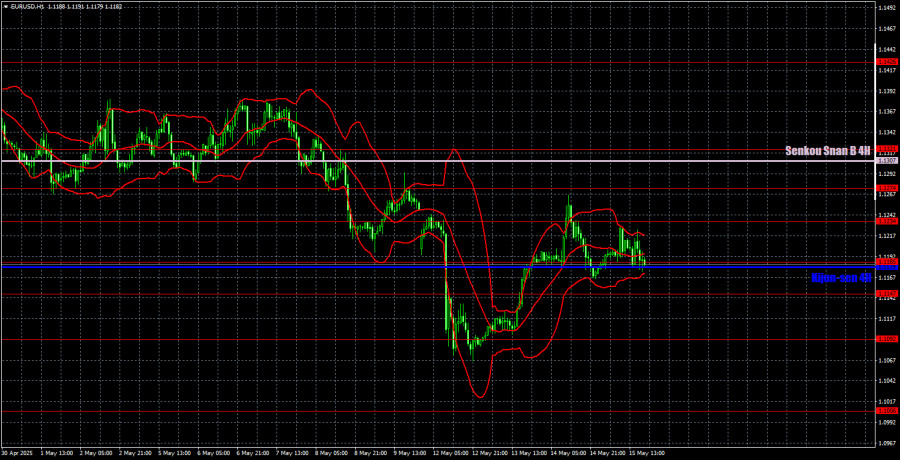

EUR/USD 5-Minute Analysis

On Thursday, the EUR/USD currency pair showed only one thing—a complete unwillingness to move. We observed sideways movement throughout the day despite a fairly packed macroeconomic calendar. However, as mentioned in the previous article, while EU and U.S. reports might spark minor reactions, this data isn't enough to drive meaningful shifts. The market focuses solely on news related to the trade war or other high-profile statements by Donald Trump.

Nevertheless, we must point out the second estimate of the EU's Q1 GDP report. The initial estimate prompted traders to look optimistically at the euro, as the EU economy was reported to have grown by 0.4%. However, the second estimate showed a slowdown in economic growth. Meanwhile, U.S. data had no impact on the pair's movement.

As a result, the price pulled back slightly from Wednesday's highs but maintains a bearish trend overall. Since the U.S. has taken a path toward de-escalating the trade conflict, we assume that further strengthening of the U.S. dollar is likely. However, this strengthening will likely not be quick or easy.

On Thursday, the price rebounded three times from the 1.1179 (Kijun-sen line)–1.1185 area. In none of these instances was the pair able to reach the nearest target at 1.1234, although it approached that level closely twice. Thus, traders could open long positions, which could not have resulted in a loss. As for profits, they were possible only if the trades were closed manually.

COT Report

The latest COT (Commitment of Traders) report is dated May 6. As shown in the chart above, the net position of non-commercial traders remained bullish for a long time. Bears briefly took the lead but quickly lost it. Since Trump took office, the dollar has been in free fall. We can't say with certainty that the dollar's decline will continue, and the COT reports reflect the actual sentiment of large players, which can change rapidly under current circumstances.

We still see no fundamental factors for the euro to strengthen, but one major factor remains for the dollar to fall. The pair may continue to correct for several more weeks or months, but a 16-year downtrend will not reverse quickly. Once Trump concludes his trade wars, the dollar may return to growth.

The red and blue lines have crossed again, indicating a return to a bullish trend. Over the last reporting week, the number of longs among the "non-commercial" group decreased by 2,200, and the number of shorts decreased by 2,100. Accordingly, the net position remained virtually unchanged for the week.

EUR/USD 1-Hour Analysis

On the hourly timeframe, EUR/USD initiated a fairly substantial decline, followed by an equally strong correction. The pair's further downside prospects still depend entirely on developments in the global trade conflict. If trade agreements are signed and tariffs lowered, the U.S. dollar could continue climbing back toward the levels from which it initially fell. Technical analysis and macroeconomic data currently play only a minor role. Everything depends on news concerning trade negotiations.

Key Levels for May 16: 1.0823, 1.0886, 1.0949, 1.1006, 1.1092, 1.1147, 1.1185, 1.1234, 1.1274, 1.1321, 1.1426, 1.1534. Ichimoku Lines: Senkou Span B – 1.1307, Kijun-sen – 1.1179. Note: These Ichimoku indicator lines may shift throughout the day, so consider that when interpreting signals. Also, don't forget to move your Stop Loss to breakeven once the price moves 15 pips in the expected direction—this will help protect against false signals.

On Friday, the Eurozone has no major economic events scheduled, while the U.S. will release another set of secondary reports. The only item of interest might be the University of Michigan Consumer Sentiment Index, but it is scheduled for release in the evening. Thus, we are likely to observe the same calm movements with low volatility and sideways dynamics throughout the day—unless Donald Trump once again takes center stage.

Illustration Explanations:

- Support and resistance price levels – thick red lines where movement may end. They are not trading signal sources.

- Kijun-sen and Senkou Span B lines—These are strong Ichimoku indicator lines transferred to the hourly timeframe from the 4-hour one.

- Extremum levels – thin red lines where the price has previously rebounded. These act as trading signal sources.

- Yellow lines – trend lines, trend channels, and other technical patterns.

- COT Indicator 1 on the charts – the size of the net position for each category of traders.