The EUR/USD currency pair traded with a slight decline on Friday, and overall volatility has decreased after the "crazy April." The U.S. dollar has been strengthening for over a month, although this growth looks quite weak. While the dollar has managed to halt its freefall, its outlook remains uncertain and largely dependent on Donald Trump and the outcome of the global trade conflict. Let's break it down.

We've already stated that the U.S. dollar should continue strengthening if the trade war continues to de-escalate. We even allow for the possibility of the dollar returning to its original positions in the 1.03–1.04 range. After all, the dollar began its collapse from these levels when Trump started implementing tariffs, threatening both the U.S. and global economies. The global economy may not significantly impact the dollar, but the American economy certainly does.

In other words, the market dumped the dollar due to fears of recession and a significant rate cut by the Federal Reserve. However, suppose Trump and his administration manage to sign trade deals with all the countries on the "blacklist" (especially China and the EU). In that case, the terms of trade will become more favorable for the U.S. Of course, we shouldn't forget that import tariffs will inevitably reduce export volumes to the U.S. Higher prices will lower demand, and in monetary terms, the U.S. economy will take a hit. However, the U.S. budget will benefit from increased revenue.

This is a complex issue, and most experts avoid making forecasts about the U.S. economy's condition several months or a year ahead. Even if Trump secures favorable trade deals, who's to say he won't launch a new trade war or make decisions that again threaten the economy? This uncertainty is precisely why the dollar often fails to rise, even when all favorable conditions exist.

Therefore, we believe that as the trade war continues to de-escalate, the dollar will strengthen slowly and modestly. The Federal Reserve also lends some support to the U.S. currency, as its monetary policy remains hawkish. Unlike the European Central Bank and the Bank of England, it hasn't cut rates.

The dollar's long-term prospects depend entirely on Trump and his future decisions. If the U.S. president continues to upend the global order, the dollar could resume its collapse. There's no reason to expect that outcome now, so we believe the dollar will continue a weak corrective rise. On the 4-hour chart, the price remains below the moving average, indicating a downtrend. The macroeconomic backdrop continues to be mostly ignored by traders.

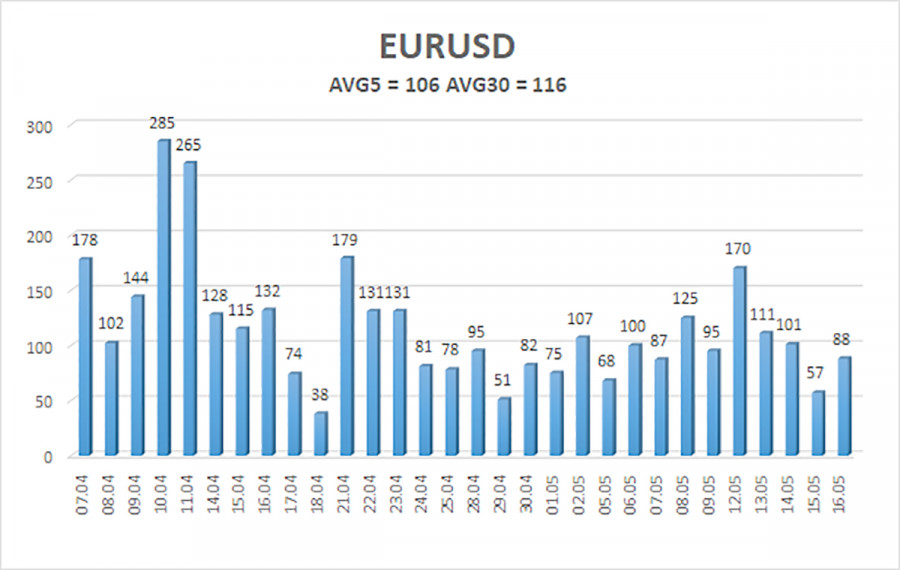

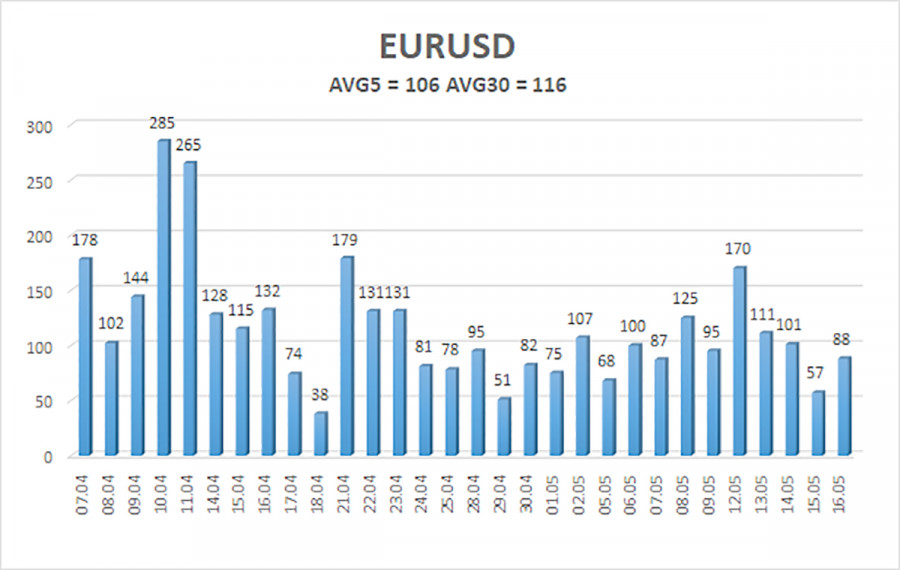

The average volatility of the EUR/USD pair over the past five trading days as of May 19 is 106 pips, which is considered high. We expect the pair to move between 1.1059 and 1.1271 on Monday. The long-term regression channel points upward, indicating a short-term uptrend. The CCI indicator recently dipped into oversold territory, which, during an uptrend, signals a trend continuation. However, the trade war still has a far greater impact on price movement than technical indicators. A bullish divergence formed a bit later, triggering a new upward swing.

Nearest Support Levels:

S1 – 1.1108

S2 – 1.0986

S3 – 1.0864

Nearest Resistance Levels:

R1 – 1.1230

R2 – 1.1353

R3 – 1.1475

Trading Recommendations:

The EUR/USD pair continues a downward correction within a broader uptrend. For months, we've consistently said we expect a medium-term decline in the euro, and this outlook hasn't changed. Aside from Donald Trump, the U.S. dollar still has no reason to weaken. But lately, Trump has been pushing for a trade truce, meaning the trade war factor now supports the dollar, which could eventually return to levels around 1.03. Under current circumstances, long positions are not relevant. As long as the price remains below the moving average, short positions remain relevant with targets at 1.1108 and 1.1059.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.