Analysis of Trades and Trading Tips for the British Pound

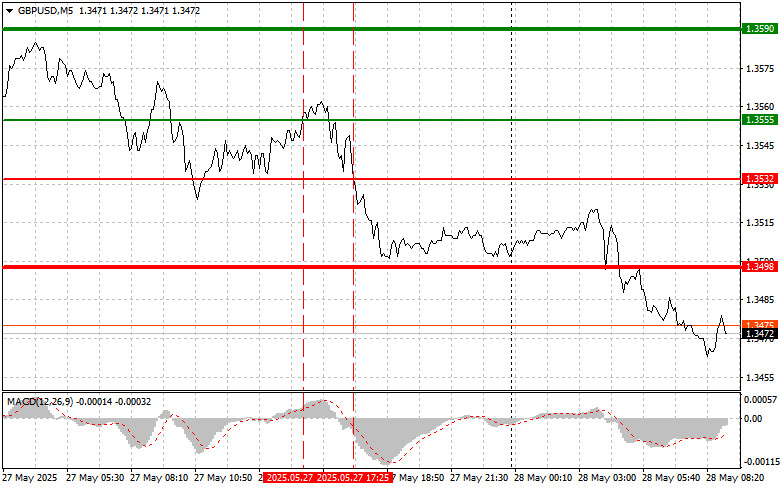

The price test at 1.3532 in the second half of the day occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downside potential. For this reason, I chose not to sell the pound.

As yesterday's data showed, consumer confidence in the U.S. rebounded sharply in May from a nearly five-year low, resulting in a stronger U.S. dollar and a decline in the British pound. The unexpected surge in the index, reflecting American consumers' optimism about the current economic situation and short-term prospects, surprised the market. This immediately affected currency markets, where the U.S. dollar significantly strengthened against most major currencies, including the pound. The reasons for the rise in consumer confidence lie in several factors. First is the labor market's resilience, which continues to create new jobs and maintain a low unemployment rate. Second is the gradual decline in inflation, which, though slow, gives consumers hope for price stabilization.

Today, aside from a speech by Bank of England Deputy Governor for Monetary Policy Clare Lombardelli, no reports are expected. This means pressure on the GBP/USD pair may persist. The absence of macroeconomic data leaves room for speculative movements and technical trading. The market will closely monitor Lombardelli's speech for hints regarding the Bank of England's future monetary policy. Investors will be keen to understand how determined the central bank is and whether it will resume cutting interest rates at the next meeting. Any signs of a more dovish stance could further pressure the pound.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

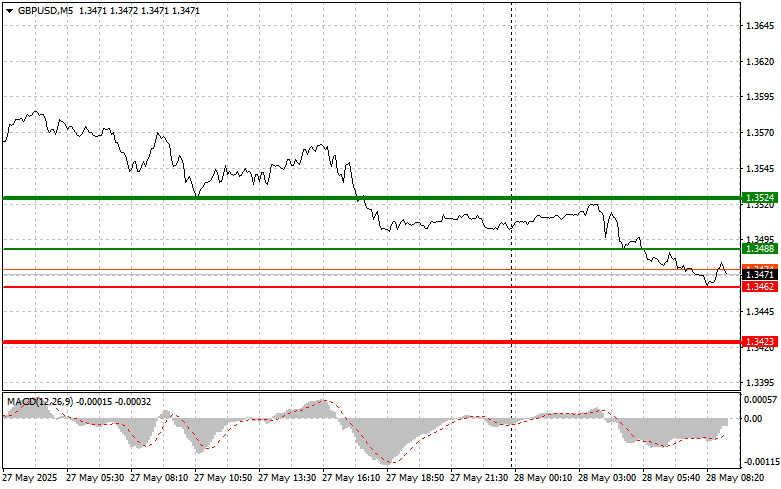

Scenario No. 1: Today, I plan to buy the pound at the entry point around 1.3488 (green line on the chart) with a target of rising to 1.3524 (thicker green line). At 1.3524, I plan to exit the long position and open a short position in the opposite direction, expecting a move of 30–35 pips in the opposite direction. Any anticipated growth in the pound today would be seen only as a corrective move. Important! Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario No. 2: I also plan to buy the pound today if there are two consecutive tests of the 1.3462 level when the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to an upward reversal. A rise to the opposite levels of 1.3488 and 1.3524 can be expected.

Sell Scenario

Scenario No. 1: Today, I plan to sell the pound after a breakout below the 1.3462 level (red line on the chart), which could lead to a rapid decline in the pair. The key target for sellers will be 1.3423, where I plan to exit the short position and immediately open a long position in the opposite direction (expecting a 20–25 pip move in the opposite direction). Selling the pound is reasonable after a failed attempt to break above the daily high. Important! Before selling, make sure the MACD indicator is below the zero line and starting to decline from it.

Scenario No. 2: I also plan to sell the pound today in the case of two consecutive tests of the 1.3488 level when the MACD indicator is in the overbought zone. This will limit the upside potential of the pair and lead to a reversal downward. A decline to the opposite levels of 1.3462 and 1.3423 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.