Trade Review and Recommendations for Trading the Euro

The price test at 1.1398 occurred when the MACD indicator had just begun moving down from the zero line, which confirmed a valid entry point for selling the euro and resulted in a 20-point drop in the pair.

However, positive data from Italy's industrial sector and optimistic investor sentiment as reflected in the Sentix index allowed euro buyers to neutralize the negative impact. The euro demonstrated resilience, supported by internal economic factors signaling a recovery in the eurozone economy. The increase in industrial production in Italy, a key component of the European economy, indicates positive trends in the manufacturing sector. The Sentix index, which reflects financial market participants' sentiment, also contributed to the euro's stabilization. The index's stronger-than-expected reading points to growing optimism about the European economy's outlook and encourages capital inflows into the euro. Thus, a combination of favorable macroeconomic data and improved investor sentiment has created a supportive environment for the euro's strengthening.

In the near term, the only notable upcoming publication is the NFIB Small Business Optimism Index in the U.S. Therefore, market focus remains on the progress of trade negotiations between China and the U.S. While the NFIB index holds some interest for analysts and economists, its current market impact is minimal compared to the geopolitical backdrop. The influence of trade talks on global markets cannot be overstated. Any signs of convergence between the world's two largest economies are immediately reflected in currency dynamics. The market is in a state of tense anticipation, akin to the calm before the storm. Every tweet, every leaked headline, and every unofficial comment is scrutinized and interpreted. Investors are prepared to respond swiftly to any signals that might hint at the outcome of the negotiations.

In the current environment, market participants are advised to act with caution and restraint in their investment decisions. It is unwise to rely on short-term speculation based on unverified rumors.

As for intraday strategy, I will continue to rely on the execution of Scenarios #1 and #2.

Buy Signal

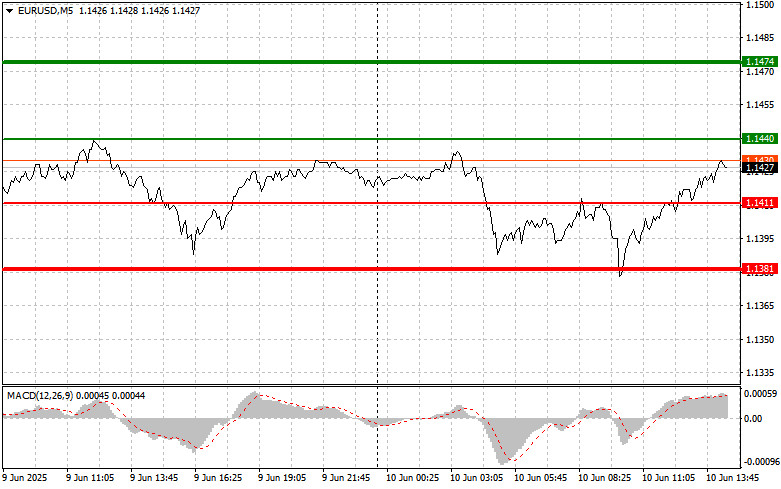

Scenario #1: Buy the euro today upon reaching the entry point around 1.1440 (green line on the chart) with the target of rising to 1.1474. At 1.1474, I plan to exit long positions and sell the euro in the opposite direction, aiming for a 30–35 point retracement. A bullish outlook for the euro is justified only after negative trade negotiations. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1411 price level when the MACD indicator is in the oversold zone. This would limit the pair's downward potential and trigger a reversal to the upside. A rise to the opposite levels of 1.1440 and 1.1474 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.1411 level (red line on the chart). The target will be 1.1381, where I plan to exit short positions and enter long trades in the opposite direction (aiming for a 20–25 point retracement). Pressure on the pair may return following successful trade negotiations. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1440 price level while the MACD is in the overbought zone. This would cap the pair's upward potential and trigger a reversal downward. A decline to the opposite levels of 1.1411 and 1.1381 can be expected.

On the Chart:

- Thin green line – entry price for buying the trading instrument

- Thick green line – target price to set Take Profit or manually fix gains, as growth above this level is unlikely

- Thin red line – entry price for selling the trading instrument

- Thick red line – target price to set Take Profit or manually fix gains, as further decline below this level is unlikely

- MACD Indicator – entry signals are based on overbought and oversold zones

Important: Beginner Forex traders should exercise great caution when entering the market. It is best to avoid trading ahead of key fundamental releases to steer clear of sharp price swings. If you decide to trade during news events, always use stop-loss orders to minimize losses. Without them, you could quickly lose your entire deposit—especially if you neglect money management and trade large volumes.

And remember, successful trading requires a clear trading plan like the one outlined above. Making spontaneous trading decisions based on the current market situation is a losing strategy for intraday traders.