The EUR/USD currency pair remained virtually motionless throughout Friday. This lack of movement is easy to explain: Friday was U.S. Independence Day, with American markets closed. However, we may see more active trading on Monday.

The economic calendar for Monday contains no notable events. Nevertheless, three major developments occurred over the weekend. On Friday, Trump signed the "One Big Beautiful Law" and announced that notifications were being sent to all trade partners without finalized deals, informing them of new tariffs taking effect on August 1. On Saturday, Elon Musk announced the creation of the "American Party," as he had previously promised.

These three developments are highly significant. The only question is how the market will respond. There are many possible scenarios. Traders might ignore the "One Big Beautiful Law," as its content has long been known, and given the Republican majority in both chambers of Congress, its approval was never in doubt.

There's also nothing new in the tariff hikes. Trump had openly stated his intent to raise tariffs to their original levels for any country that doesn't make him an "offer he can't refuse." In other words, he was expecting advantageous deals, not fair negotiations. Out of 75 countries, only three accepted such terms. What's surprising is that the new tariffs are set to begin not on July 9, but on August 1. Why the delay?

The most intriguing development is Musk's announcement of the "American Party." The billionaire ran a poll on his social media platform X, asking if Americans wanted a new political force to challenge both Democrats and Republicans. Two-thirds of more than a million respondents said yes. However, it's important to note that X users are primarily young, tech-savvy, and likely fans of Musk. With a U.S. population of around 340 million, one million votes represent only a fraction, and these results don't reflect nationwide public opinion. Young people, IT workers, and progressive individuals may support Musk, but that doesn't mean he has the backing of ethnic minorities, migrants, retirees, the working class, or wealthy elites.

Therefore, the "American Party" currently looks more like an interesting project than a serious political contender. Its success will depend on Musk's promises to the public and how Trump reacts. Trump has already vowed to cancel all subsidies for Musk's companies and is considering deporting the "chief illegal immigrant in the U.S." As a result, we may witness a new Trump-Musk confrontation. Additionally, Democrats are unlikely to welcome a viable third political force. It's hard to predict how traders will react. If they believe Musk's party could gain real power, it might be a positive signal for the dollar. However, any potential political shift wouldn't realistically happen until after the next U.S. elections—several years from now.

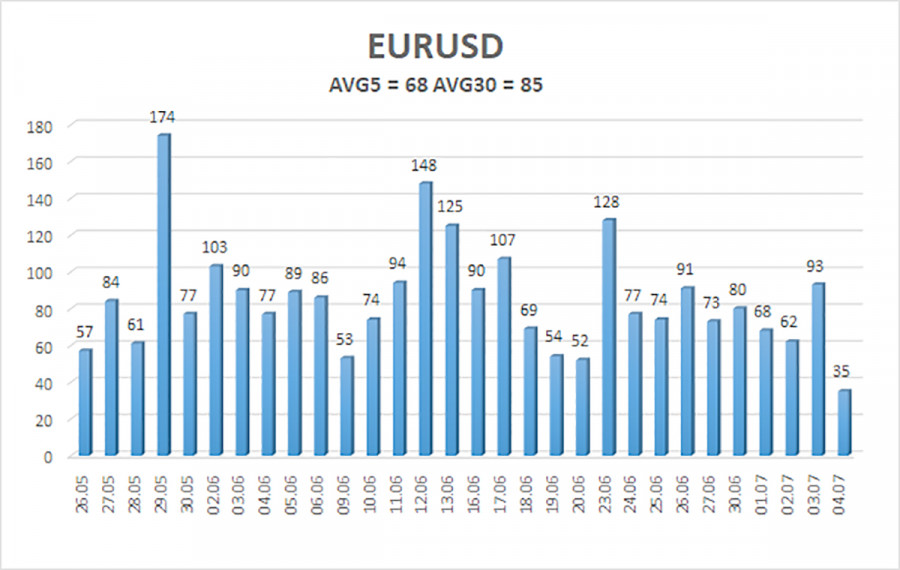

EUR/USD Average Volatility

As of July 7, the average EUR/USD volatility over the last five trading days is 68 points, classified as "moderate." On Monday, we expect the pair to move within the 1.1711–1.1847 range. The senior linear regression channel continues to point upward, indicating a sustained uptrend. The CCI indicator recently entered overbought territory and is now showing bearish divergences. However, within an uptrend, such divergences typically signal a potential correction, not a trend reversal.

Nearest Support Levels:

- S1 – 1.1719

- S2 – 1.1597

- S3 – 1.1475

Nearest Resistance Levels:

Trading Recommendations:

The EUR/USD pair remains in an uptrend. U.S. dollar dynamics continue to be heavily influenced by Donald Trump's domestic and foreign policies. Additionally, the market often interprets economic data in a way that undermines the dollar—or ignores it altogether. We continue to observe the market's complete reluctance to buy the dollar under any circumstances.

If the price drops below the moving average, short positions targeting 1.1597 may be considered, though a significant decline is unlikely under current conditions. As long as the price stays above the moving average, long positions targeting 1.1841 and 1.1847 remain relevant in continuation of the trend.

Explanations to the illustrations:

- Linear Regression Channels – Help define the current trend. When both channels point in the same direction, the trend is strong.

- Moving Average Line (settings 20,0, smoothed) – Identifies short-term trend direction and helps guide trading decisions.

- Murray Levels – Target zones for trend moves or corrections.

- Volatility Levels (red lines) – Represent the expected price range for the day based on current volatility data.

- CCI Indicator – Readings below -250 (oversold) or above +250 (overbought) indicate a potential trend reversal.