Trade Review and Tips for Trading the Euro

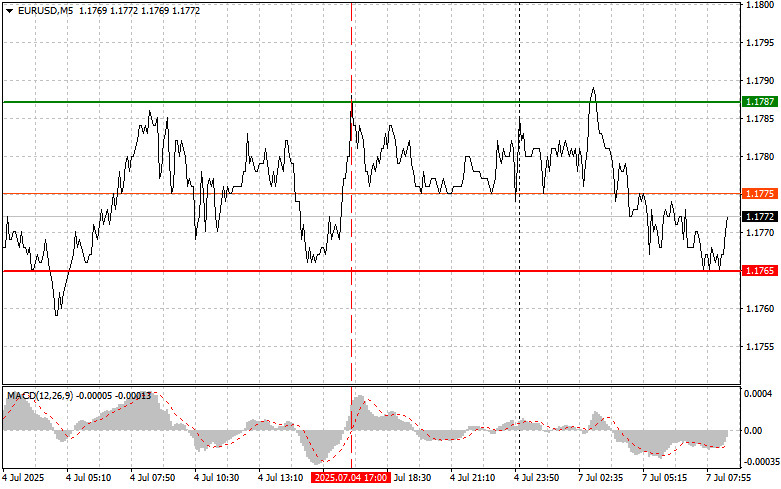

The price test of 1.1787 occurred when the MACD indicator had already risen significantly above the zero line, which limited the pair's upward potential. For this reason, I did not buy the euro.

Low trading volume on Friday due to the U.S. Independence Day holiday impacted the market. Currently, the main focus is on the prospects of a trade agreement between the U.S. and the European Union, although no substantial progress has been observed so far. Trump has already initiated the process of sending notifications about new tariffs against trade partners that have not reached an agreement with the U.S., which puts pressure on the European side of the negotiations. The American side maintains a firm stance. The demands to ease trade restrictions and open the European market to U.S. goods may be unacceptable to some EU countries, which fear adverse consequences for their national economies and producers. In the coming days, we should expect an intensification of the negotiation process and diplomatic efforts, as the July 9 deadline is approaching fast.

This morning, a number of key economic indicators are expected to be released, including German industrial production data, the Sentix investor confidence index for the eurozone, and May retail sales statistics in the eurozone. These events will undoubtedly influence market sentiment and may trigger fluctuations during the European trading session. Special attention will be paid to German industrial production, a key indicator of the eurozone's economic health. Poor results may reinforce concerns about slowing economic growth and prompt the European Central Bank to adopt a more cautious monetary policy. The Sentix index, as a leading economic indicator, will help assess near-term outlooks. A decline in this index may point to growing pessimism about the economic situation and a reduction in investment. Meanwhile, the retail sales data will reflect the state of consumer spending, a major component of economic growth. Finally, Joachim Nagel's speech will be closely watched for any hints regarding the future monetary policy of the European Central Bank.

As for intraday strategy, I will rely primarily on the implementation of Scenarios #1 and #2.

Buy Scenarios

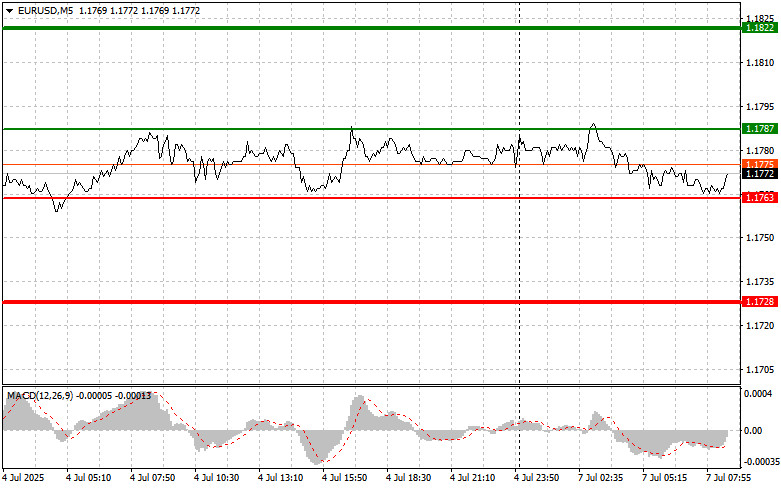

Scenario #1: Today, I plan to buy the euro at around 1.1787 (green line on the chart), targeting a rise toward 1.1822. At 1.1822, I plan to exit the market and sell the euro in the opposite direction, expecting a move of 30–35 points from the entry point. A bullish move can be expected today if the data is strong.Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.1763 level while the MACD indicator is in the oversold area. This would limit the pair's downward potential and lead to a reversal to the upside. Growth toward the opposite levels of 1.1787 and 1.1822 can be expected.

Sell Scenarios

Scenario #1: I plan to sell the euro after the price reaches 1.1763 (red line on the chart). The target is 1.1728, where I intend to exit the market and immediately buy in the opposite direction, aiming for a 20–25 point move back up. Selling pressure on the pair may return if the data turns out weak.Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1787 level while the MACD indicator is in the overbought area. This would limit the pair's upward potential and lead to a downward market reversal. A decline toward the opposite levels of 1.1763 and 1.1728 can be expected.

Chart Key:

- Thin green line – entry price for potential buy trades.

- Thick green line – projected price where Take Profit can be set or profits manually locked in, as further growth above this level is unlikely.

- Thin red line – entry price for potential sell trades.

- Thick red line – projected price where Take Profit can be set or profits manually locked in, as further decline below this level is unlikely.

- MACD Indicator – use overbought and oversold zones as guidance for entering trades.

Important: Beginner traders in the Forex market must be extremely cautious when making trade entry decisions. Before the release of important fundamental reports, it's best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always set stop-loss orders to minimize potential losses. Without stop-losses, you can quickly lose your entire deposit, especially if you're trading large volumes and not applying proper money management.

And remember, successful trading requires a clear trading plan—like the one I've presented above. Spontaneous trading decisions based on current market conditions are a losing strategy for intraday traders.