The GBP/USD pair continued its downward movement on Tuesday, which continues to puzzle observers. As we've repeatedly noted, no instrument in any market can move in the same direction indefinitely. Even the U.S. dollar, which in 2025 has faced persistent pressure, cannot fall continuously. From time to time, market participants will take profits, pause, or wait for key news or events. These pauses often lead to temporary corrections—one of which we may now be witnessing.

In the EUR/USD article, we already discussed that for Trump and his policy agenda, the priority is revenue. Donald Trump returned to office on promises to reduce spending, cut the national debt, and narrow the trade deficit. Yet nearly six months into his term, the trade deficit remains at levels similar to those under Biden, and Trump's new legislation foresees an increase in national debt by 3.3 trillion dollars. This raises the question: if debt is projected to rise over the coming years, will the budget truly become balanced through trade wars, cuts to social and healthcare programs, and similar measures?

In our view, Trump understands well that the U.S. has lived on borrowed funds for decades, constantly increasing its financial obligations. This is partly what has sustained economic prosperity, as the country annually spends more than it collects in revenue. However, each new loan increases the burden on the federal budget. More and more borrowing is required. In June alone, the U.S. Treasury spent 145 billion dollars on debt servicing—a new record. Monthly Treasury bond payments continue to grow year by year, and it is unclear how Trump intends to reduce the national debt.

In reality, Trump has not cut expenditures but expanded them, and now he needs new sources of revenue. Hence the persistent pressure on the Federal Reserve. Lower interest rates reduce the incentive for investors to hold cash. They also lower Treasury yields, easing the debt burden. In addition, lower rates tend to boost investment in the economy. Trump wants to reboot the U.S. economy and chart a new direction—but instead of a reset, his administration has started with disruption.

Ideally, revenue collection should have come first, followed by tax cuts and increased spending on defense and immigration services. Trump chose the opposite: spend first, then generate revenue. A typical American credit model. The results are already evident—economic slowdown, rising tariffs, increased actual spending, and proposed budget cuts targeting low-income populations, whom Trump perceives as contributing little to the economy.

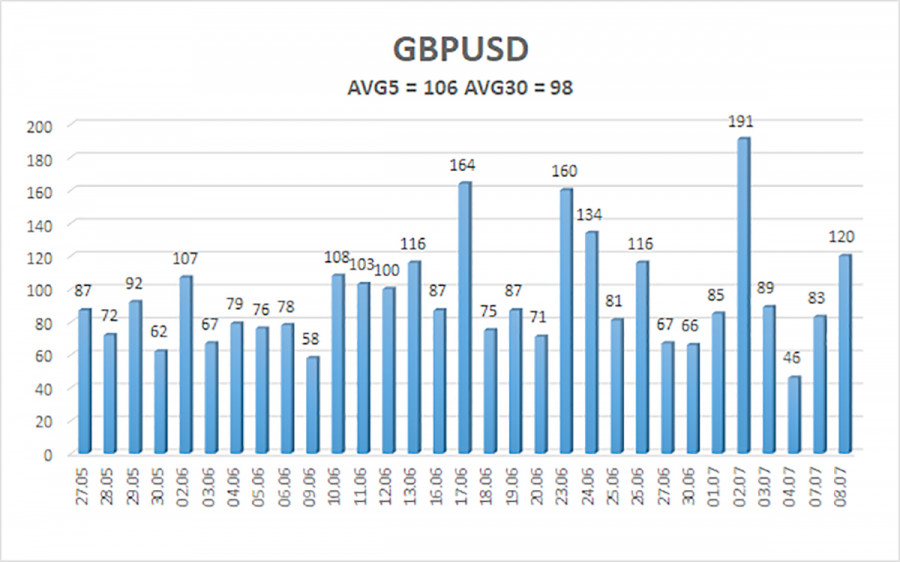

Average Volatility

The average volatility for GBP/USD over the past five trading days is 106 points. For this pair, that is considered "moderate." On Wednesday, July 9, we expect movement within the 1.3465–1.3677 level. The senior linear regression channel points upward, indicating a clear upward trend. The CCI indicator has entered oversold territory for the second time recently, which may signal a resumption of the upward trend. Additionally, a bullish divergence could form today.

Nearest Support Levels:

- S1 – 1.3550

- S2 – 1.3489

- S3 – 1.3428

Nearest Resistance Levels:

- R1 – 1.3611

- R2 – 1.3672

- R3 – 1.3733

Trade Recommendations:

The GBP/USD pair continues a weak downward correction that may soon come to an end. Over the medium term, Donald Trump's policies are likely to keep pressuring the dollar. Therefore, long positions with targets at 1.3699 and 1.3733 remain valid as long as the price stays above the moving average. If the price moves below the moving average, short positions with targets at 1.3550 and 1.3501 may be considered. However, strong dollar appreciation is not expected under current conditions. Occasional corrective movements are possible, but a sustained rally would require concrete signs of an end to the global trade conflict.

Illustration Notes:

- Linear regression channels help identify the current trend. If both point in the same direction, the trend is strong.

- The moving average line (settings: 20,0, smoothed) shows the short-term direction and trading bias.

- Murray levels indicate price targets for movements and corrections.

- Volatility levels (red lines) suggest the probable price channel for the coming day based on current volatility.

- CCI indicator: Values below -250 or above +250 may signal a potential trend reversal.