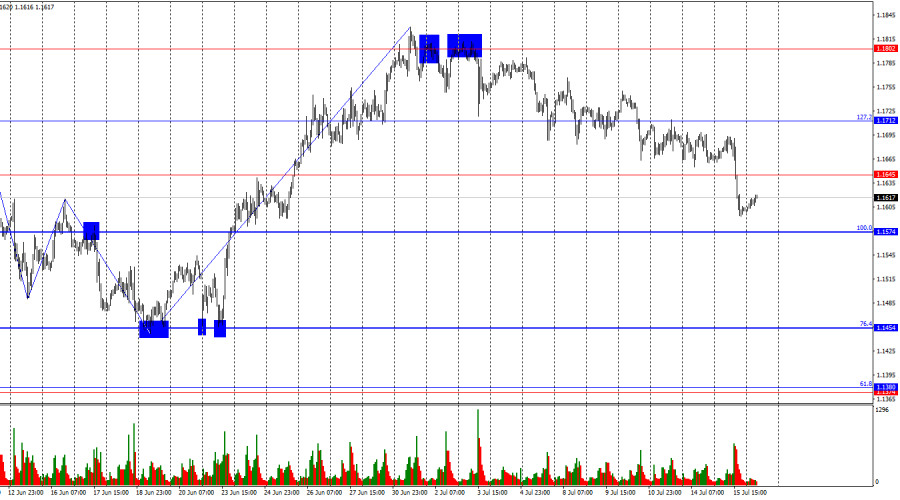

On Tuesday, the EUR/USD pair continued its decline, dropping sharply by 85 points. A firm close below the 1.1645 level allows us to expect a further fall toward the next 100.0% retracement level at 1.1574. A rebound from 1.1645 would also suggest a new downward movement. A rebound from the 1.1574 level would work in favor of the euro and signal a possible recovery toward 1.1645.

The wave structure on the hourly chart remains simple and clear. The last completed upward wave broke the high of the previous wave, while the new downward wave did not even approach the previous low. Therefore, the trend is still considered bullish at this time. The lack of real progress in U.S. trade negotiations, the low probability of trade deals with most countries, and another round of tariff hikes continue to cast a bleak outlook for the bears—though they have been on the offensive in recent weeks.

The only reason for Tuesday's EUR/USD crash was the U.S. Consumer Price Index. Inflation in the U.S. accelerated to 2.7%, confirming the Federal Reserve's and Jerome Powell's darkest expectations. Since the Fed Chair was correct about the impact of trade tariffs on inflation, no monetary policy easing should be expected at the next meeting. I also doubt that inflation will slow over the next two months, so I'm not anticipating a rate cut in September either. Based on this assumption, bears launched another attack—the third in the last three weeks. In my view, the dollar didn't really need such a sharp rise on Tuesday, as the Fed has been saying the same thing for three months: monetary policy settings will not change until the full effects of Trump's trade war are evident. This suggests that the Fed has maintained a wait-and-see stance both then and now. So, the inflation report did not significantly alter the market's dovish expectations—nor did it reinforce them.

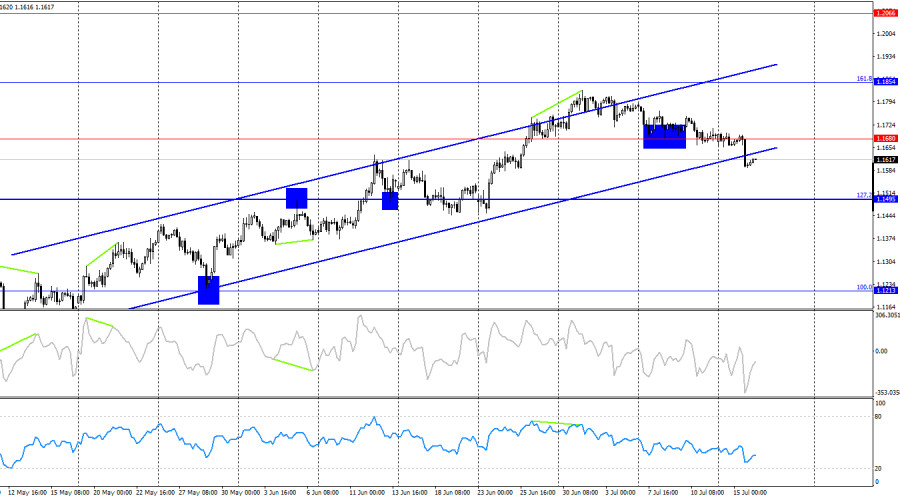

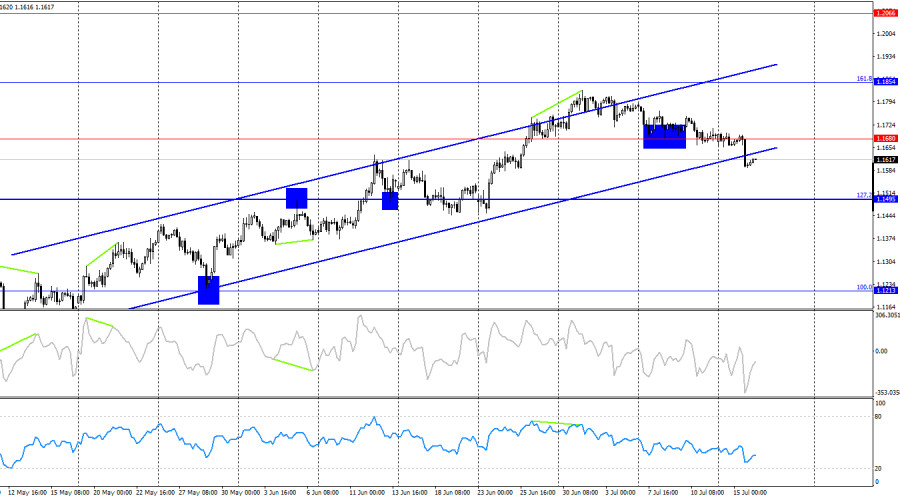

On the 4-hour chart, the pair closed below the 1.1680 level and below the ascending trend channel. Thus, the bullish trend is starting to shift toward a bearish one, but I would hesitate to draw such a strong conclusion. Despite the fact that the U.S. dollar has been strengthening for the third week in a row, its fundamental foundation remains very weak. It seems to me that the market is not ready to buy the dollar for months or years to come. Traders don't understand what the consequences of the trade war will be for the U.S. itself, so the current dollar rally looks like an attempt to mislead market participants.

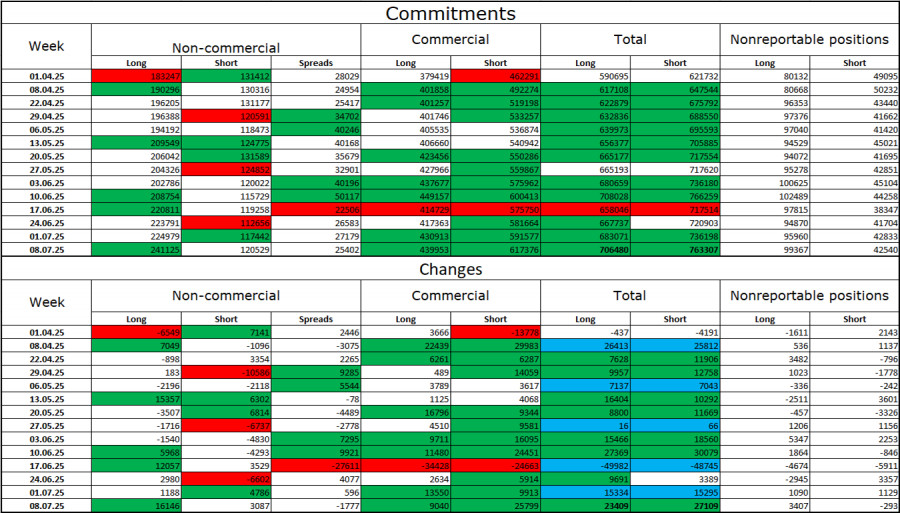

Commitments of Traders (COT) Report:

During the latest reporting week, professional players opened 1,188 new long positions and 4,786 short positions. The sentiment of the "Non-commercial" group remains bullish, thanks to Donald Trump, and continues to strengthen over time. The total number of long positions held by speculators is now 225,000, while short positions stand at 117,000—this gap, with rare exceptions, continues to widen. Therefore, the euro remains in demand, and the dollar does not. The overall picture has not changed.

For twenty-two consecutive weeks, large players have been reducing short positions and increasing longs. The difference in monetary policy between the ECB and the Fed is significant, but Donald Trump's policies are an even more influential factor for traders, as they could trigger a recession in the U.S. economy and lead to numerous other long-term structural issues for America.

News Calendar for the U.S. and the Eurozone:

- U.S. – Producer Price Index (12:30 UTC)

- U.S. – Industrial Production Change (13:15 UTC)

The economic calendar for July 16 contains two entries, neither of which can be considered important. The influence of the news background on market sentiment on Wednesday is expected to be minimal.

EUR/USD Forecast and Trading Advice:

I would not recommend selling the pair today, as the recent movement has been too weak and unstable. Buy positions are possible on a bounce from the 1.1574 level on the hourly chart with a target at 1.1645, since the bulls' positions still appear significantly stronger than the bears'. Buying is also possible on a close above 1.1645 with a target at 1.1712.

The Fibonacci level grids are constructed from 1.1574–1.1066 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.